Karin Tenenboim, Investment Manager at Newtopia VC, participated in the Tech Advisor round hosted by TRIBU Tech Latam, where she explained how the process of Venture Capital Investment in Latam works, and provided various recommendations and advice to achieve it.

TRIBU Tech Latam is a software community for Latino developers whose main mission is to collaborate personally and professionally for their own growth, uniting and empowering developers from Latin America for the world. In this context, TRIBU carries out a series of events with various specialists who address different topics acting as «Tech Advisors».

On November 10 the time came to talk about Venture Capital in a lecture featuring our Investment Manager, who explained in detail the VC world, the vision of the market in the current Latin American situation, and provided valuable information for all of those who seek to obtain investment from this sort of funds.

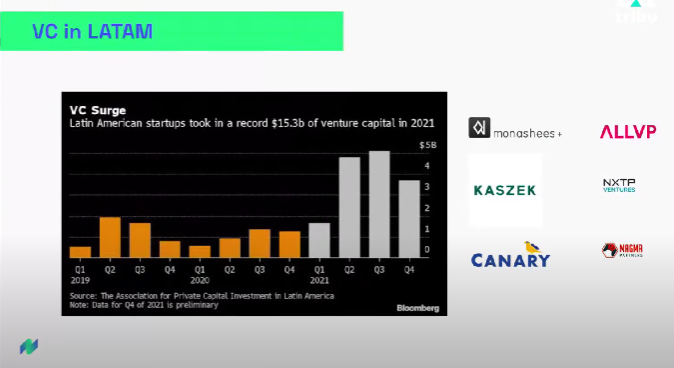

Venture Capital funds and their growth in LATAM

To kick-off her presentation, Karin provided a brief definition of Venture Capital: «I like to define it as entrepreneurship capital, sometimes it is called risk capital, but for me it has a negative connotation. Basically, it is a capital investment to acquire an equity stake in a small and medium-sized company, usually in a startup, which is executed by VC firms.”

On the other hand, she spoke about the VCs’ mindset, marking the difference with other types of investments and clarifying that «it is an asymmetric investment, there is a benefit that can be unlimited, but the probability of success is very low«. And she explained that, from her position as Investment Manager, «it is a matter of ruling out the reasons why it would not be successful, and focusing on the reasons why it would be.»

Regarding the current situation in the region in terms of Venture Capital, in 2021 in Latin America there was a growth peak, it reached 16 billion invested and the upward trend continues. “This boom was determined by success stories that brought the attention of global investors and this generated more and more funds. It is something super good for the ecosystem and entrepreneurs”.

Although she highlighted that the trend is towards greater growth, she acknowledged that «a few months ago we saw a fairly significant decline that shook everyone a bit, but I think it has to do with normal cycles that happen from time to time and I don’t think they affect in the medium and long term the trust that people have in the potential of startups or in VC as an asset”. And she highlighted:

VC funds have capital, what LATAM needs is many more startups.

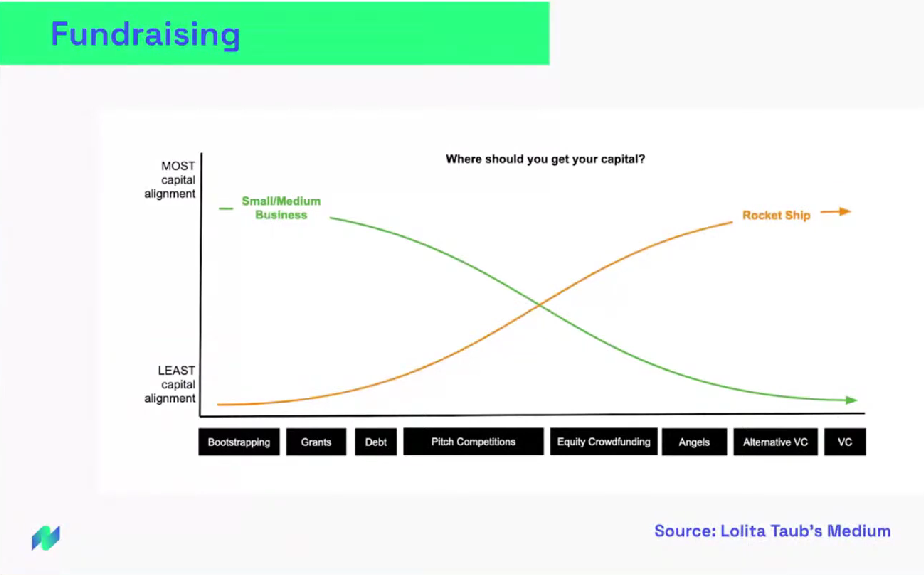

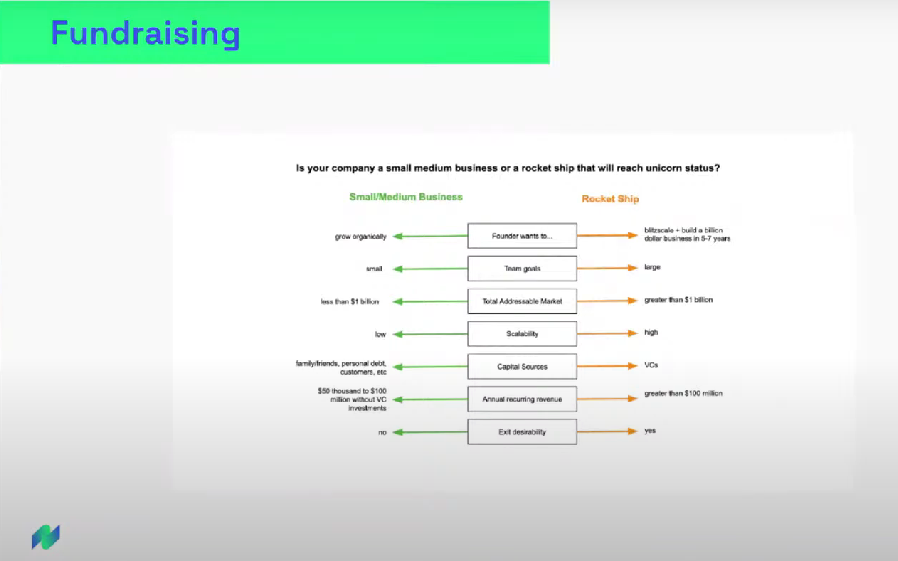

Who can raise Venture Capital investments

“Most businesses are not suitable for VC and although it sounds shocking, it is something that happens”, Karin explained and emphasized: “It is a problem and hopefully with the VC boom more alternative funding sources will emerge for entrepreneurs, since banks are not a good option in Latin America”.

In addition, she elaborated on the characteristics that a startup must meet in order to be eligible and receive VC investments, indicating that «it is for technology-based companies that can meet the standard of achieving exponential growth with a low budget.»

To this extent, Karin highlighted some specific advice for all those founders who seek to raise VC investment: “It is very important to plan the investment round, to know how much is needed and is going to be done with it. Put together a good deck, a good pitch and a data room so that the investor understands more about the subject matter”.

When asked about the 3 key aspects that VC fund investors take into account when evaluating projects, she listed:

- That entrepreneurs can convey the vision, venture capitalists invest in them, in people, and when they are starting and they don’t have anything yet, we’re betting on their vision.

- Back storytelling with data, base it on metrics, be clear about the industry numbers, who the players and competitors are.

- Demonstrate that there is a concrete plan and how it will be executed. Also having previous experience implementing is super important.

In addition, she included in her presentation a set of specific recommendations for all those founders who are thinking of getting ready to raise VC capital, among which she highlighted podcasts, books, documentaries and even Twitter accounts that provide valuable information:

About Newtopia VC

About Newtopia VC

Karin spoke about Newtopia VC’s mission:

“We are a fund that invests in very early stages. We like to accompany entrepreneurs who are reinventing industries or building companies that can be innovative, with regional or global scalability, and that are led by outstanding entrepreneurs”.

And she added: «We offer strategic mentoring from our partners, fireside chats with entrepreneurs, workshops with experts, we help them with business connections, with contacts so they can continue raising capital, and we put a lot of focus on the Community.

At this point, she explained: «We really like that the founders connect with each other and with the fund’s investors in order to put together a Community that can empower everyone.»

In addition, she clarified that at Newtopia

«we are agnostic in the industries in which we invest, we have investments in all kinds of startups and verticals.»

In case you want to know more about how Venture Capital investments work, Here you can access the full talk.

So.. are you an entrepreneur and you want to get in touch with us to analyze what you are building? That’s great! We really appreciate that interest.

If after reading our Manifest, you consider that you check all of the boxes, do not hesitate applying to Newtopia!

About Newtopia VC

About Newtopia VC