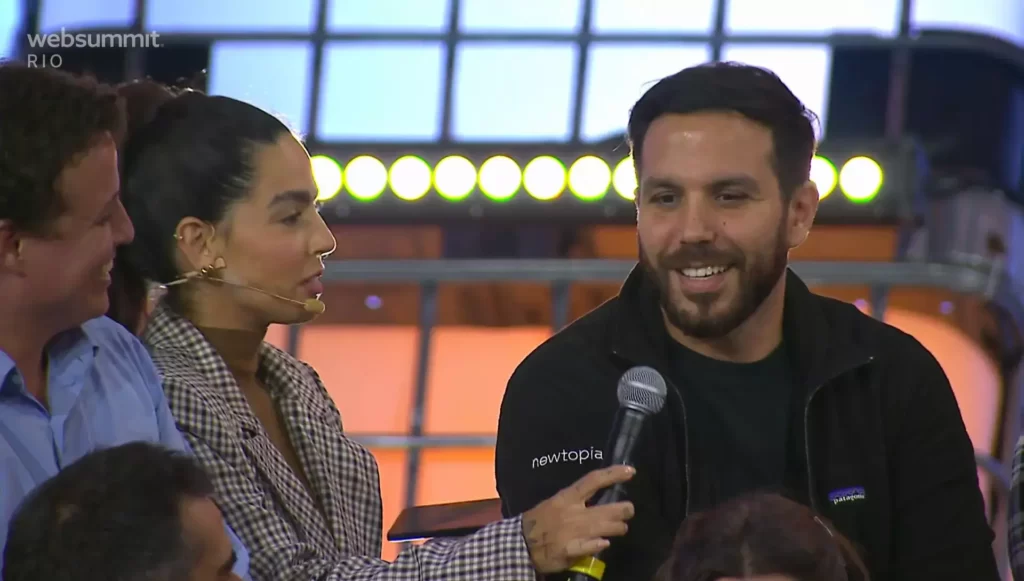

Sacha Spitz, Co-founder & Managing Partner of Newtopia VC, was invited to speak and serve as a jury member at Web Summit Rio 2023.

During Day 1 of the conference, he shared the stage with Gina Gotthilf (Co-founder & COO, Latitud), Izabel Gallera (Partner, Canary), Michael Nicklas (Managing Partner, Valor Capital Group) and Gustavo Brigatto (Founder & Editor-in-chief, Startups) on the Venture Stage to talk about the characteristics of world-class founders.

In this article, we will go over the main takeaways from the top-tier panel and explore what investors look for in founders and the recipe for success.

Founding a successful startup is a daunting task, but it’s not limited to having a specific background. Anyone can do it as long as they identify a problem and gather the necessary resources to solve it.

Innovation often stems from encountering a problem, and this exposure can come from anywhere. While money is most of the times required to build a scalable business, raising capital is not always necessary to start a business.

The key is to understand why capital is needed and how it will be used, as well as having a clear vision for the business.

Observe Opportunities From Problems

A good founder is one who identifies a (big) problem and iterates value propositions to find a solution for it. It’s not mandatory to have a specific background or education; just the willingness and drive to solve a problem.

Solving a problem with an unfair advantage, exhibiting resilience, and having ambition are characteristics that attract investors.

Founders who have a clear vision of where they want to take their business are the ones who capture the attention of investors.

Founding a successful startup is a daunting task, but it’s not limited to having a specific background. Anyone can do it as long as they identify a problem and gather the necessary resources to solve it. Innovation often stems from encountering a problem, and this exposure can come from anywhere.

While money is most of the times required to build a scalable business, raising capital is not always necessary to start a business. The key is to understand why capital is needed and how it will be used, as well as having a clear vision for the business.

Personality Check: The Need for Passion and Obsession

Personality Check: The Need for Passion and Obsession

When considering investment opportunities, investors will conduct a thorough background check on founders to ensure they are a good fit for investment. Passion and obsession are qualities that make a great founder.

Obsession with the problem, obsession with the customer, with metrics, and the storytelling ability are the 4 of the main things that make an amazing founder:

- Conversely

- Not being interdisciplinary

- Having an unbalanced cap table

- Not being passionate about the problem at hand are red flags for investors.

Later Stages Offer More Data

Curiosity, focus on the product, attracting top talent, storytelling, and leadership are important characteristics for founders to have at all stages.

But in the later stages the founders will have to offer more data regarding customer acquisition costs and lifetime value for example, to show evidence of the potential size and beauty of the business ahead.

Cold Emails ¿Yes or No?

Warm introductions are also recommended when reaching out to investors for their attention. Overall, while there is no set recipe for a successful founder, investors are looking for individuals who can persuade and excite others about their vision, and who have a track record of success.

Sending a cold email or LinkedIn message will not take the startup to the next level in most of the cases, therefore the general recommendation is always trying to get “someone” to make the intro with the VC Latam, it can be other VC, or an angel investor, or a former colleague of yours that is close to someone at the VC, or another entrepreneur from inside or outside of the portfolio; but we often see this as the proper path to capture attention in a faster and deeper way.

VC firms in the region are still looking for amazing founders to support them in building great companies. So, keep being an entrepreneur, keep being wonderful, keep creating things that are incredibly great, and we are confident that you will secure funds to grow your company.

Personality Check: The Need for Passion and Obsession

Personality Check: The Need for Passion and Obsession